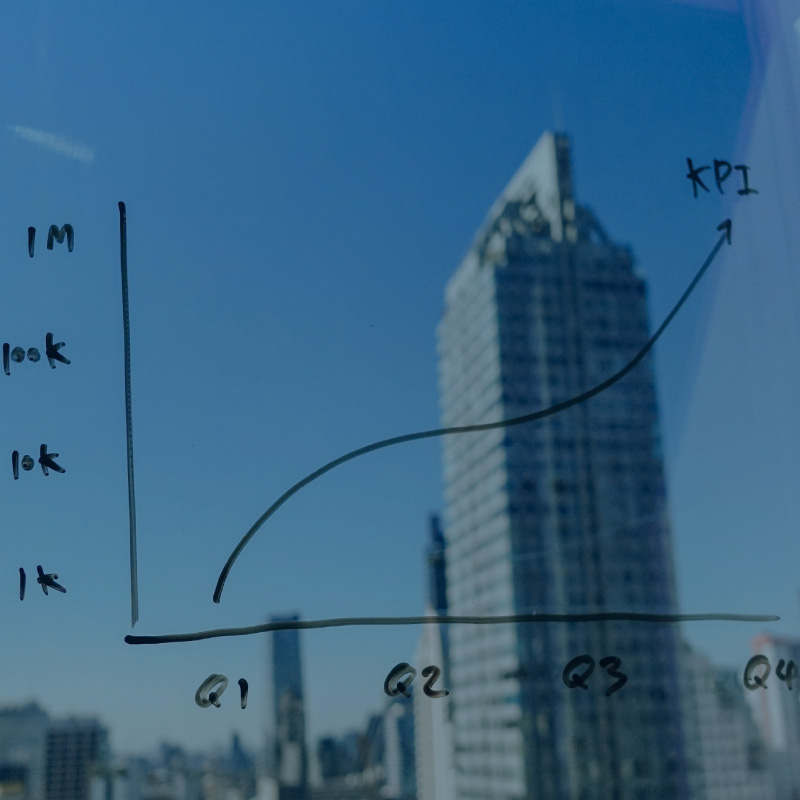

Analytics technology can help predict how variability affects demand. But how does a global pandemic impact your forecasts? Forecasting sales is a crucial step in optimizing the supply chain, and with the help of analytics technology, it is possible to fine-tune our forecasts in the midst of this humanitarian disaster.

The Coronavirus is currently affecting and will continue to affect the supply chain of the majority of organizations. It can intervene in two ways: by increasing demand beyond forecasts or, on the contrary, decreasing it. Therefore, we need a way to forecast the impact of this pandemic on our sales.

The Coronavirus reveals how much we rely on the offline channel

While the sale in physical stores decreases every year as online sales technologies gain more importance, the truth is that 80% of transactions still occur in brick-and-mortar stores, face-to-face.

Most companies understand this effect when adverse weather conditions disrupt a specific area and they experience a significant drop in sales. This effect can also be observed during tragedies like the one we are currently experiencing with the rapid and widespread spread of this virus, resulting in a lack of customer attendance in stores for their routine purchases.

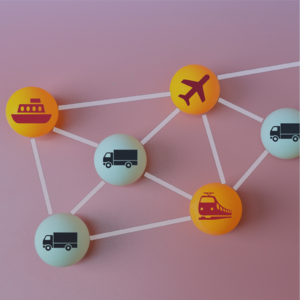

Many companies are starting to feel the impact of the so-called COVID-19 on the availability of products manufactured in China. Given China's role as a global exporter of goods, this is a serious problem, and as time goes on, we will see the real impact of it.

The cost of overreacting and not reacting

Initially, the virus was discussed as a problem that only affected the Asian continent and would not impact the rest of the world. The reality has been quite the opposite—it is a global pandemic.

When trying to mitigate the risk, companies need to understand how the virus will affect sales during and after the outbreak. If there is an exaggerated reaction to the initial sales decline, the retail industry may not be prepared for the surge when things calm down. If consumer behavior is ignored, there may be an excess of inventory, tying up all the money in stock.

Business owners need to delve deeper into how their specific industry sector reacts during these times and what behaviors their consumers will exhibit in the future, including demand forecasting.

What will exactly happen in a specific market, and how will the Coronavirus impact our forecasts?

These are just some of the key factors that Imperia SCM considers could affect forecasts.

Does the pandemic coincide with your peak selling season?

While some companies may benefit from this tragedy, such as mask manufacturers, other sectors will be severely affected due to sales losses. Many companies have a high sales season (seasonal sales) that contributes a significant portion of their annual revenue.

A virus that is constantly spreading and keeps people at home during the peak selling season will cause disruptions in companies' annual accounts. While there is no way to know when and how it will end, it is crucial to consider your peak selling season and when it is at the highest risk due to external variables that can eliminate sales, which logically cannot be recovered.

Observe and analyze sales channels

As mentioned earlier, there are still many retailers that heavily depend on foot traffic, such as grocery stores, consumer products, fashion, etc. If customers stay at home, they will turn to online shopping. In the era of major distribution companies like Amazon or eBay, traditional retailers can hardly afford to close for a weekend. Understanding the presence of multiple sales channels and adapting to the environment is key. Analytics technology is essential to understanding consumer habits during events like the current pandemic and adapting sales strategies accordingly.

Impact on markets and customers

Lastly, we cannot deceive ourselves; this virus will cost supply chains and consumers a lot of money. The economy has already begun to feel these impacts, with the largest drop in the history of the Spanish stock market, as the IBEX 35 fell by 14.07% and Wall Street plummeted. The question is, how long will it affect us? As markets react, consumer spending tends to decline. While this could be widespread and affect many companies, sectors that are more affected by discretionary spending and key recession indicators may experience a greater impact. Understanding how our customers react to these factors can help us prepare.

Forecasting consumer behavior during a black swan event is challenging but not impossible. Analytics technology is essential for better anticipating consumer behavior during and after an event, along with good data and trained professionals in demand forecasting. The goal is not to predict a virus but to gain a better understanding of consumers and how external events affect sales forecasts.

From the Imperia SCM team, we wish a swift recovery to all those affected by this virus.

Imperia_thumbnail.jpg)